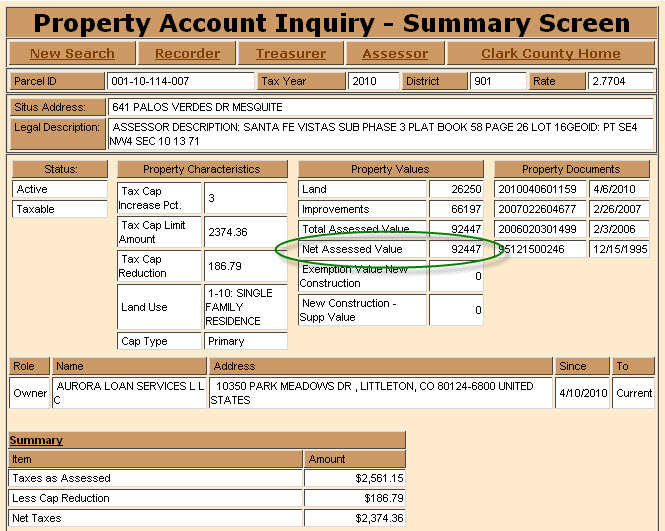

Nevada Property Tax Bills

The Clark County Assessor’s office just finished mailing out Tax Cap Abatement notices. It’s important to fill out the card or your tax rate could increase by nearly 8%.

The Clark County Assessor’s office just finished mailing out Tax Cap Abatement notices. It’s important to fill out the card or your tax rate could increase by nearly 8%.

You are entitled to a lower tax increase as long as your property is your primary residence. However, if you just bought a new home, the tax cap doesn’t apply the first year because the base has to be set for your taxes.

“Here in Clark County and Nevada, we do have a tax abatement program that will only allow your taxes to increase no more than 3% or up to 8% for any other properties over the taxes that you paid the previous year. It’s not the value of your home but the tax paid in the previous year. This is why it is so important that you fill that card out and send it back,” said Clark County Assessor Briana Johnson.