Is the Housing Market going to Crash?

The housing market has been showing signs of growth and stability over the past few years, despite a few dips and hiccups along the way, leading many people to wonder if it is headed for a crash. But, despite the occasional panic, the short answer to this question is: no.

The housing market has been showing signs of growth and stability over the past few years, despite a few dips and hiccups along the way, leading many people to wonder if it is headed for a crash. But, despite the occasional panic, the short answer to this question is: no.

The reasons are multifold. First, there are significant differences between the housing market of today and the market leading up to the housing crash of 2008. Starting from fundamentals, the average mortgage debt-to-income ratio, a key indicator of financial risk and affordability, is much lower now than it was pre-crash. This means homebuyers are taking on fewer risks and have far more buying power. Additionally, lending standards have tightened significantly since 2008, which has drastically reduced the risk of defaults and foreclosures.

During the lead-up to the housing crisis, it was much easier to get a home loan than it is today. Banks were creating artificial demand by lowering lending standards and making it easy for just about anyone to qualify for a home loan or refinance an existing one.

As a result, lending institutions took on much greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices. Today, things are different, and purchasers face much higher standards from mortgage companies.

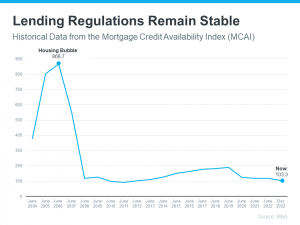

The graph below uses data from the Mortgage Bankers Association (MBA) to help tell this story. In this index, the higher the number, the easier it is to get a mortgage. The lower the number, the harder it is.

This graph also shows just how different things are today compared to the spike in credit availability leading up to the crash. Tighter lending standards have helped prevent a situation that could lead to a wave of foreclosures like the last time.

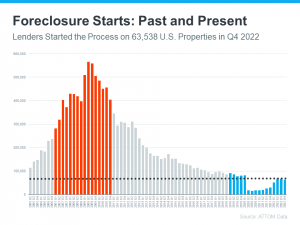

Another difference is the number of homeowners that were facing foreclosure when the housing bubble burst. Foreclosure activity has been lower since the crash, mainly because buyers today are more qualified and less likely to default on their loans. The graph below uses data from ATTOM to show the difference between last time and now:

So even as foreclosures tick up, the total number remains very low. And on top of that, most experts don’t expect foreclosures to go up drastically as they did following the crash in 2008. Bill McBride, Founder of Calculated Risk, explains the impact a significant increase in foreclosures had on home prices back then – and how that’s unlikely this time.

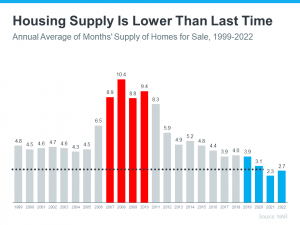

For historical context, there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to fall dramatically. Supply has increased since the start of this year, but there’s still a shortage of inventory available overall, primarily due to years of underbuilding homes.

The graph below uses data from the National Association of Realtors (NAR) to show how the months’ supply of homes available now compares to the crash. Today, unsold inventory sits at just 2.7 months’ supply at the current sales pace, which is significantly lower than the last time. There just isn’t enough inventory on the market for home prices to come crashing down like they did last time, even though some overheated markets may experience slight declines.

The current economy is much more stable than it was heading into the crash in 2008. Unemployment is at a historical low, and wages are steadily increasing. This boosts people’s ability to take on a mortgage as well as their ability to pay it back.

Overall, the housing market is healthy and, barring unforeseen economic shocks or major disruptions looks unlikely to crash any time soon.