House hunting is fun. Touring homes, picturing furniture, imagining your morning coffee on a new patio. But here’s the truth most buyers learn the hard way: none of that matters unless your financing is already lined up.

House hunting is fun. Touring homes, picturing furniture, imagining your morning coffee on a new patio. But here’s the truth most buyers learn the hard way: none of that matters unless your financing is already lined up.

That’s why pre-approval should come before open houses, not after. Whether you’re buying next month or just testing the waters, getting pre-approved is one of the smartest moves you can make. Here’s why.

1. What Pre-Approval Really Means

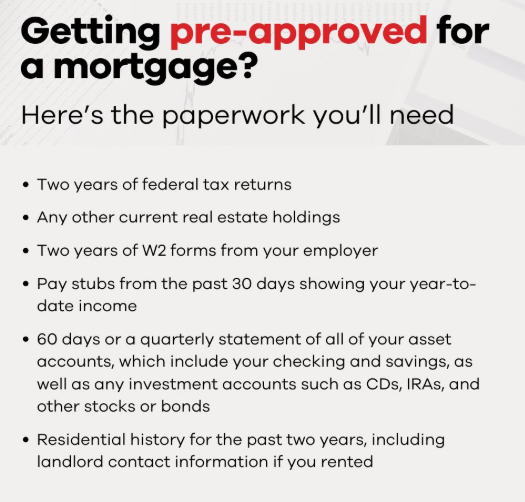

Pre-approval isn’t a rough estimate or a hopeful guess. It’s a lender taking a real look at your financial picture. Income, credit, debts, assets, savings, all reviewed to determine how much home you can realistically purchase.

Think of it as a roadmap for your home search. Instead of wondering what might work, you’ll know exactly where you stand and can shop with confidence and clarity.

2. Why Pre-Approval Is a Power Move Right Now

Today’s housing market is shifting. Mortgage rates move, prices adjust, and inventory changes from month to month. Pre-approval gives you a firm footing in a market that can otherwise feel unpredictable.

Here’s what it does for you:

Clarity

You know your numbers upfront, so you don’t fall in love with a home that stretches your budget too far.

Credibility

Sellers take pre-approved buyers seriously. It tells them you’re prepared, qualified, and not likely to fall apart at the finish line.

Control

If the right home hits the market or rates dip, you’re ready to act instead of scrambling to catch up.

As Experian puts it:

“…you’ll want to make sure you receive your preapproval letter before you start looking at homes so you can submit a strong offer as soon as you find what you want. The process can take anywhere from a day to a few weeks, so if you procrastinate, you may lose out to a competing offer.”

Pre-approval also strengthens your offer in a very real way. According to Greg McBride, Chief Financial Analyst at Bankrate:

“Preapproval carries more weight because it means lenders have actually done more than a cursory review of your credit and your finances… A preapproval means you’ve cleared the hurdles necessary to be approved for a mortgage up to a certain dollar amount.”

In plain English: sellers trust pre-approved buyers more. And in a market where well-priced homes still move quickly, that trust matters.

3. You Don’t Have to Be “Ready” to Get Pre-Approved

One of the biggest misconceptions is that pre-approval means you’re committing to buy immediately. You’re not.

Most pre-approvals are valid for 60 to 90 days and can be updated if your plans or finances change. It simply means you’re prepared.

Here’s a question worth asking yourself:

If the perfect home came on the market today, could I make a strong offer?

If the answer is “not yet,” then pre-approval is your next step.

Bottom Line

Pre-approval doesn’t limit you. It opens doors.

In today’s market, successful buyers aren’t the ones waiting on the sidelines. They’re the ones who plan ahead. If buying a home is even a possibility in the next few months, start by connecting with your real estate agent and a trusted lender.

They’ll walk you through the process, explain your options, and make sure that when the right home appears, you’re ready to move with confidence.

Houses that are priced, presented & marketed correctly are selling fast.

Let my 30+ years of Real Estate experience in Las Vegas work for you. 702-378-705

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Very Vintage Vegas does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Very Vintage Vegas, will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.