Watching The Numbers

If there’s any one thing that I’m not…it’s a statistician. Sometimes 2 plus 2 equals 4 however. I just make sure I don’t get all my information from Wall Street.

RISMEDIA, July 14, 2008-Amidst the gloom on Wall Street about housing someone forgot to check the stats. The National Association of Realtors® has now reported four straight months of rising housing prices, but it seems no one is listening.

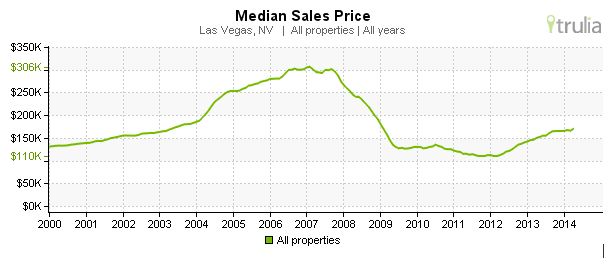

According to NAR statistics, the median home price has fallen from a high of $230,200 in July 2006 to a low in February 2008 at $195,600, a drop of 15%. Since February, however, it has risen steadily every month. By May the index (which will be revised on July 24) had risen to $208,600, up $13,000 and a full 6.6%. Another indicator, the mean home price (otherwise known as the average home price), has also shown strength and has risen from a low of $242,000 also in February of this year to $253,100, a rise of $11,100 or 4.5%. It, too, has risen every month since February of this year.

We’ve been talking about foreclosures since they account for a big chunk of the inventory. I’ve actually gotten more leads and people starting their home search with the foreclosures. The fantasy of 1/2 price housing is very exciting. The reality is a little different. Many realize quickly that by the time you buy them, fix them up and make something of them that they might be better off buying a non-foreclosure in the first place.

It’s a little different out in the suburbs where so many of the bank owned homes are relatively new, and have mostly cosmetics to deal with. In Vintage Vegas, many of the bank owned homes are truly broken down houses. I’m always on the hunt for the best HOUSE at the best price. But it scares me when someone without the resources or money AFTER THE CLOSING wants to by a “fixer-upper”. That’s what I call a big mistake!

The banks who own the foreclosures know this. That’s why we’re seeing the spread between list price and sale price on the foreclosure shrinking dramatically. I’ve been writing lots of offers on the foreclosures, (and getting some of the accepted). The banks are not jumping on any old offer that comes along. They’re stacking the offers, and trying to get a bidding war going. If that approach doesn’t work for them, then they’ll counter back a few thousand less than their list price.

We’re seeing the regular first time home buyer or sideline buyer jumping back into the water. The numbers have ALREADY shifted as the article I quoted above from RISMEDIA notes.