How The Foreclosure and Lending Crisis Came To Be

For months now, I’ve been hearing CNBC talking heads talk about “Mark To Market” accounting rules and how they should be changed or repealed. None of them ever really explained to me what it means.

I found this great video and that explains it real well. I see now that what I’ve been saying about the REAL value of our homes isn’t really what the foreclosures are selling for. It’s just that the foreclosures are current market, and if you’re going to sell…you’ve also got to “mark to market”. All of the appraisers are doing just that.

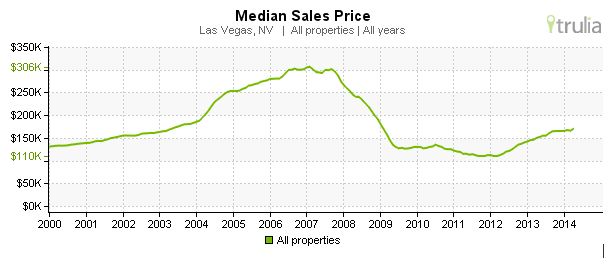

I’ve been telling everyone for a year to just sit tight if you’re not HAVING to sell. If you HAVE to sell, then you’re just like the banks and will have to “mark to market”.

On the positive note, there’s suddenly a lot of people saying to me “get me what you can for my old house. I’m going to trade it in on a bigger, better one (or smaller, even cheaper one). As long as you’re buying another, replacement home at a give away price, then you’re just trading even for one you’d rather have than the one you have now.

If you can afford to sell, and would actually rather be in a better or different home, then think about the fact that you’ll be buying in again at 2000 or earlier prices with historically low interest rates.

Watch the video here, or read a synopsis of it just below the video. It’s long by “short attention span” standards, but worth watching. The video isn’t embeddable, so you’ll have to click away to see it.

Here’s a snippet:

So what’s the problem?

Before we get into what this means for banks, let me make a quick analogy using a scenario that should make perfect sense to you and your clients.

Let’s imagine that you own a house in a neighborhood where all of the houses are priced at around $300,000.

Unfortunately, your neighbor, who owns his home free and clear, falls ill and needs emergency cash quickly. Because he is under duress, he must sell the home for $200,000 in order to get the cash he needs right away, even though the home is worth considerably more.

Now would this mean that your home is now worth the same $200,000 that your neighbor sold his for? Of course not, because you are not forced to sell under duress. It just means that your new neighbor got a great deal.

However, if you were a publicly traded company and had to abide by Mark to Market accounting rules, you and the rest of your neighbors would now have to say, by law, that your home was worth only $200,000 – not the $300,000 you would get for it if you actually sold. So what’s the big deal? Read on.

Then, there’s this video which has been making the rounds of the Realtor Community. It’s hysterically funny and pathetically sad at the same time. If you actually click on it to watch it directly at the YouTube site, then you’ll see that there’s a lot of other parodies using the same footage.

I’ve been sitting on it for a couple of weeks, and finally decided, what the hell, since it also makes the point about the foreclosure and lending crisis and how it affects all of us.