Foreclosure Moratorium Ends Without Any Media Coverage – Good News? or Bad News?

Late last year, with lots of fanfare and media coverage, Fannie Mae put a moratorium on new foreclosures. They said they wouldn’t initiate any new foreclosures during the moratorium.

The moratorium ended on April 1st. There was practically no coverage of the event in the press. The only thing I could find on it was in the Washington Independent. That’s bad news for thousands of homeowners who were riding it out by staying in their homes. Many took advantage of the time it allowed them to do loan modifications, file bankruptcy, or make other arrangements. A lot of people who didn’t care whether they kept the home or not, merely used it as a way to stay put without making any payments. This means there’s a lot more foreclosures out there waiting to go back to the banks.

But there’s some good news buried in this. Good news, that is, for the buyers who are about to start looking, or those that have been frustrated, by the multiple offer difficulties in landing a deal.Â

There was a second part of the moratorium that no one knew about. Fannie also put the brakes on releasing new property that they already owned to the market. The banks are sitting on an enormous inventory that hasn’t been put out to market yet. The moratorium for releasing new inventory ended today.

I’ve confirmed this with several of the top REO listing agents, (those few who I have respect for). The good news for all the frustrated buyers who’ve been bidding on the few good, livable, decent foreclosures, is that there’s about to be a flood of new listings. I’m told that there’s going to be about 8000 homes released in the next 2 months. Different banks have been given dates that they can start releasing. Remember, various banks actually are the servicing companies for Fannie Mae and Freddie Mac. They won’t all show up immediately, but they’re not going to hoard them anymore.

By hoarding the inventory, they gave time for the buyers to gear up, for the administration to put the 8000 first time home buyer tax credit in place, and to clear out a lot of the already on the market inventory. As I’ve reported, the number of sales has risen dramatically, and the existing inventory has dropped by over 25%.

The press and media have taken notice, and even the New York Times reported Monday that things are turning around.

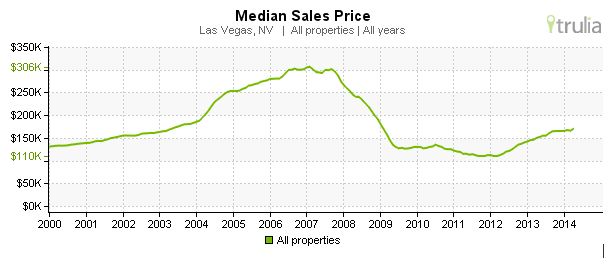

Investors and first-time buyers, the traditional harbingers of a housing rebound, are out in force here, competing for bargain-price foreclosures. With sales up 45 percent from last year, the vast backlog of inventory has diminished. Even prices, which have plummeted to levels not seen since the beginning of the decade, show evidence of stabilizing.

Indications of progress are visible in other hard-hit areas, including Las Vegas, parts of Florida and the Inland Empire in southeastern California. Sales in Las Vegas in March, for example, rose 35 percent from last year.

The historic neighborhoods of Las Vegas that we cover here at VeryVintageVegas, has seen even more drastic increases in the number of sales. Current inventory of available homes in the downtown east side neighborhoods has dropped to a low of 47 homes today. There was 61 just last week when I talked about inventory levels. At the peak of the inventory last summer there were 121 homes available. Remember, in the same area that we call downtown east (Sahara to Charleston, and LVBS to Eastern) there’s 4300 total homes.

The numbers are similar in other historic neighborhoods such as McNeil and Paradise Palms. I know there’s even more buyers out there that I haven’t talked to yet, or that will be working with their cousin or bosses girlfriend or what not. The demand is high. There’s at least 10 offers (and 37 was the most I’ve seen) on any decent house that pops up in the historic neighborhoods. More inventory is a good thing, and buyers bidding them up is a good thing for all the current owners.

If you’ve tried and been frustrated, or if you’re just starting to get into the game, then it’s a real good time to update your loan or get started on it, and contact your favorite Realtor.