Investors Making It Difficult On The First Time Homebuyer

I’m going to spend more time on real estate this week. In keeping with that pledge, I thought I’d present some more proof about what I’ve been ranting about lately. I’m not the only agent with a list of frustrated buyers.

From Channel 8 Eyewitness News.

There are several houses on the market right now, but potential buyers are finding out getting into one of these homes isn’t as easy as seems. Even though foreclosed homes are getting multiple offers, hopeful buyers are learning that cash will usually win.

…..

Real estate broker Thomas Blanchard says banks are accepting lower offers from investors because they can pay cash. “They are choosing the cash offers over the conventional and FHA due to the fact that there is no appraisal needed — there’s no lender requirements. It’s a clean deal so they know when they put the deal into escrow it’s going to close,” he said.

If I were Bill Mauer, I’d be making a NEW RULE!

No Investors allowed on bank owned homes that are acceptable for FHA financing.

And / or:

Banks are required to take the highest bid.

HUD which sells the homes that are owned by FHA has this rule in place. There’s a 10 day “owner occupant only” bidding period. If it doesn’t sell to an owner occupied buyer, then it’s opened up for the investors. Some of their listings are labeled as “not eligible for FHA financing” in the first place. (All of the Hud homes are in the MLS, and easy to spot).

I’m only comfortable making that rule because the banks have gotten all the bail out money. They shouldn’t have it both ways. The banks are selling the homes for less than the market will bear, while getting taxpayer bail out money. What good are stimulous “tax credits” to first time buyers if they’re shut out of the process? As a taxpayer, that’s the top of my “infuriating” list.

We’re actually having much better luck with the short sales for the first time buyer, even though the wait is longer. The other advantange of short sales is that usually the seller is still in the house, and it’s in much better condition than the bank owned homes. Dead landscapes are a huge issue in the bank owned homes. Landscapes in the short sales tend to be neglected, but not dead.

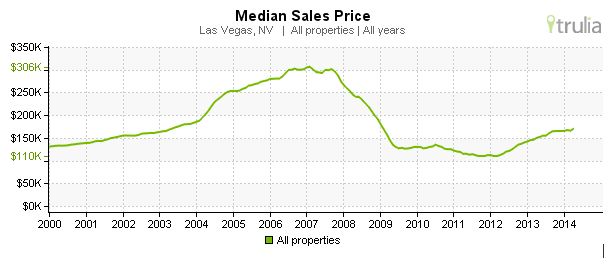

In any case, it’s still worth the time and effort since homes right now are selling at 30 to 40 percent below “fair market value”. We’re not in a fair market now. We’re actually in the “anti-bubble”. Properties are as proportionately below fair market as they were above fair market in 2006 at the height of the bubble.