Tell Congress To Extend and Expand The First Time Homebuyer Tax Credit

I can tell you from experience, and have said it many times before……

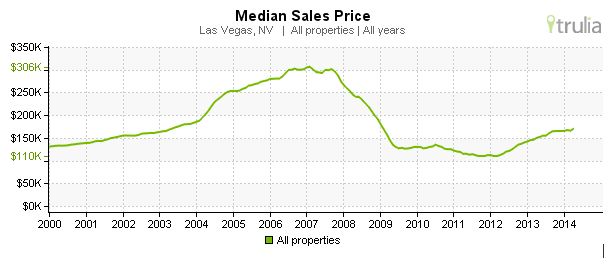

It’s not easy to buy a home now-a-days. The headlines may say the opposite, but the evil banks who control the inventory are making it difficult when they consistently take the lower cash offers for the sake of expediency. Loan guidelines seem to change daily. It’s not an easy game, but as I’ve said so many times before, it’s a game worth playing, since home prices are now 40 to 50% below fair market, historical values.

During the last year and a half, one of the things that helped make it worth while to play the frustrating game of buying a house was the FIRST TIME HOMEBUYER TAX CREDIT. It’s scheduled to expire on November 30th. Unless you are a cash buyer, it’s now too late to start the process if you’re counting on receiving the tax credit.

There’s lots of reasons that Congress needs to EXTEND and even EXPAND the credit. I personally have many buyers who have been trying to buy, and have been shut out. The number of new inquiries has slowed down dramatically since October 1st. Those that I did talk to wanted first to ask me my opinion of whether the tax credit would be extended. Those buyers are once again going to sit on the sidelines and wait to see what happens with the tax credit. I believe it will be EXTENDED AND EXPANDED, but as you will read below, we’re going to need your help to get it done.

In his testimony before the Senate Finance and Housing Committee, National Association of Realtors Vice President Ron Phipps said:

The $8000 first-time homebuyer tax credit expires as of December 1, 2009. But the usefulness of the credit diminishes daily if the credit is not extended well before that date. A homebuyer is eligible for the tax credit only if the home is ―purchased‖ before December 1, 2009. That means that buyers have to find a house, complete a contract, satisfy any contingencies, secure financing and go to closing by November 30. Accomplishing those tasks by November 30 will become more difficult with every passing day. In today’s market, it generally takes between 45 and 60 days to go from contract to closing.

Without Congressional action now, the market may freeze again – possibly as soon as this month. NAR’s research suggests that as many as 350,000 sales this year can be directly attributed to the availability of the credit. The tax credit stimulated market activity. The volume of housing sales has improved steadily every month since the credit was enacted. The credit pulled people from the sidelines and created some momentum that had been absent.

The housing market remains fragile. The market has improved and prices have stabilized in many areas, but the market has not fully corrected. Retaining the tax credit sustains that recovery. Inventory may remain unusually high. The waves of foreclosures attributable to subprime and other improper lending practices are working themselves through the system. Presently, high unemployment rates pose a threat to homeowners and could set another round of foreclosures in motion. If foreclosure rates were to spike again, inventories could become bloated again. Incentives are still needed to keep the market moving.

Home sales continue to stimulate economic activity. The economy will never fully recover until housing markets fully recover. Thus, the stimulus the credit provides is still needed. NAR estimates that every sale generates approximately $60,000 of additional economic activity. And expanding the credit beyond first-time homebuyers would give the economy a much needed kick. We continue to need the homebuyer credit. Congress must act now to be sure that the credit is available through 2010.

Here’s a video Call For Action that was put out to the Realtor Community.

Shelley Berkley, Dina Titus, John Ensign and Harry Reid need to hear from you. Even if you’re not planning on buying, you or someone you knows owns a house that’s woefully upside down. The tax credit is the best way to keep the momentum going that bring house values back to their historic REAL value.

Preferably, you’ll cut and a paste (AND SNAIL MAIL) the following letter to our Senators and Representatives. You can also email them, or at the minimum, call their office and tell them to EXTEND AND EXPAND the homebuyer tax credit. Addresses, phone numbers and email address are at the bottom.

Dear ( FILL IN THE BLANK)

The first-time homebuyer tax credit has definitely been a success. Homebuyer interest and housing sales increased almost as soon as the ink was dry on the tax credit legislation. Today’s lower prices and interest rates appeal to consumers, but it’s been the tax credit that has attracted people to open houses and to homeownership.

That progress could grind to a halt sooner than you think. Congress must act NOW to extend the credit through 2010. Otherwise, uncertainty will return and the market might again be frozen — possibly as soon as October.

A homebuyer is eligible for the tax credit only if the home is “purchased” before December 1, 2009. That means that buyers have to find a house, complete a contract, satisfy any contingencies, secure financing and go to closing by November 30. Accomplishing those tasks by November 30 will become more difficult with every passing day. In today’s market, it generally takes between 45 and 60 days to go from contract to closing.

The market has improved, but it has not yet fully corrected itself. The credit needs to be extended for an additional period of time and expanded in order to build upon the progress that’s been made. Uncertainty about the future of the credit will dampen consumer demand. The best way to assure continued housing activity is to extend and expand the credit and to do that NOW.

We can’t wait until late in the year to see what happens. Consumers will drop out soon if they can’t predict what’s in their future. Please act NOW to extend and expand the credit through 2010.

Sincerely,

[Your name]

[Your address]

I thank you for taking the effort, and so does the economy, and future home values.

Preferably SNAIL MAIL, or EMAIL or CALL your Senators and Representatives:

Senator John Ensign EMAIL LINK

119 Russell Senate Building

Washington, D.C. 20510

Phone: (202) 224-6244

Fax: (202) 228-2193

TTY: (202) 228-3364

Senator Harry Reid EMAIL LINK

522 Hart Senate Office Bldg

Washington, DC 20510

Phone: 202-224-3542

Fax: 202-224-7327

Toll Free for Nevadans:

1-866-SEN-REID (736-7343)

Congresswoman Shelley Berkely EMAIL LINK

U.S. House of Representatives

405 Cannon House Office Building

Washington, DC 20515-4708

Phone:(202) 225-5965

Fax: (202) 225-3119

Toll free: (877) 409-2488

Congresswoman Dina Titus EMAIL LINK

319 Cannon HOB

Washington, DC 20515

(202) 225-3252 or (702) 387-4941