The Most Important 2 Things You Can Do To Get Ready For Buying Your Home In An Historic Las Vegas Neighborhood

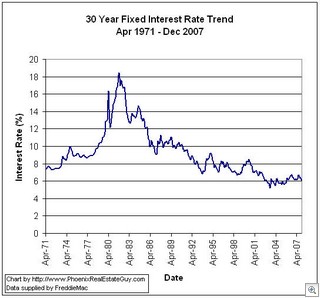

Right now we’re at 3 year lows on interest rates. Historically, there’s not much difference between now and anytime in the recent past. When I bought my first home it was 1980. Look at the chart. That was a REALLY scary time.

Right now we’re at 3 year lows on interest rates. Historically, there’s not much difference between now and anytime in the recent past. When I bought my first home it was 1980. Look at the chart. That was a REALLY scary time.

But you have to have pretty good credit scores and a down payment to get these best rates. I know many of you are thinking about getting back into the market soon, and there’s some real important things that you can do for yourself while you’re waiting.

Step One: Get Your Credit Scores As High As Possible If Want To Live In The Best Historic Neighborhoods

First, Get your credit score as high as possible. There are threshholds that will divide you into the groups of bad, fair, good and great credit. Missing one of those thresholds by a point is no different than missing it by a mile. There’s tons of free information on the web, but avoid anyone who’s going to charge you to do it for you. Do it yourself. This Article from MSN.money can get you started. Another article on credit repair from Bankrate.com gives some more advice.

Fix Your Credit But Avoid The “Credit Repair Scams”

There’s about 1000 times as many credit repair scams as there are legitimate credit repair companies. Please be very careful. You don’t need them. Bankrate.com has another very good article on the subject

Step Two: Save Up Some Money (Or A Lot, If You Can)

As contrary as it might be to the “American Way”, having money in the bank is a good thing. Start saving. Even if we do some day get back to zero down loans, you can’t go wrong having savings. And even after you make a down payment, the mortgage company is going to want to see you have money left over. They call it “reserves”. That’s the other thing that you can be doing.

There’s a lot of people ahead of you in line right now. They’ve been saving and have already verified or fixed their scores. I’ve got dozens of people on my list who are willing to buy right now……if they current house would sell. And there’s even more people on my list who are just waiting to see if they can be the one lucky lottery winner who actually times the very bottom of the market. Remember, as they used to say in Highlander “THERE CAN BE ONLY ONE”. When things pick up (and they seem to be starting to), the bottom will have passed us all by.

Are you getting ready?

If you’re already ready, give me a call. There’s plenty of great homes to choose from, and plenty of screaming bargains on the fixers and the bank owned properties. Though they’re RARELY ever the same home.

=