Phenomenal Credit Score & Report Information

As we continue to deal with a volatile stock, bond, and mortgage market, with a continued credit crunch we want to provide you with every opportunity to educate your self. This great blog post on msnbc’s redtape was forwarded to us by our friend Brian Paco Alvarez. As you read the full post on the original site, you’ll see how even a one point difference in your FICO score can save (or cost) you over $100,000.00!

Credit Scores 101: What They Are — And Aren’t read the rest

“The secret sauce behind the FICO score remains in the shadows. The formula must be a secret, the credit industry argues, because if everyone knew the exact steps to get a good score, all consumers would do those things, and the scores would become meaningless. In other words, the score would become nothing more than an indication of how well consumers could “game” the system rather than their ability to repay loans.

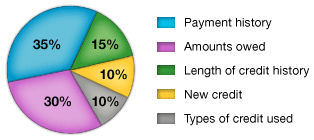

Fair Isaac has on its Web site a diagram of what goes into a credit score and what doesn’t. Every consumer should see the pie chart on this page. Boiled down, two factors account for most of a credit score, says said Lisa Nelson, vice president of global scoring for Fair Isaac: “Pay your bills on time, and don’t max out your credit cards.”

This picture was taken directly from the Fair Isaac & Co website. If you look it shows you a simple break down of what goes into your credit rating.

Back on the Red Tape Site of MSNBC, you’ll find part two of the credit score series.

Back on the Red Tape Site of MSNBC, you’ll find part two of the credit score series.

Credit Scores 102: A Crisis And Some Changes read the rest

“Many score-enhancing tricks will be “gamed” out of the system, however, by FICO 08, the new credit scoring system that Fair Isaac is expected to release later this year.

One trick that will lose its oomph is the practice of adding “authorized users” to an account. Consumers have been able to tack other users onto their credit cards and essentially “borrow” their good credit. A small cottage industry formed during the housing boom to match up willing credit “donors” with consumers who had poor credit scores.

Fair Isaac says the new scoring formula in FICO 08 will eliminate that trick and do a better job of assessing risk for consumers with so-called “thin” credit files, meaning they have few credit accounts. Recent immigrants frequently fall into this category.”

Please do take a moment, and read the full stories Credit Scores 101 and Credit Scores 102. We hope you find them useful!