ALL Real Estate Is Local – Las Vegas Leads In Improved Sales

The national numbers are out this morning from NAR – The National Association Of Realtors. You’re going to hear some bleak numbers being blah blah blahed about on CNN and MSNBC, and hopefully not on FOX.

The sales of 4.86 million units (seasonally adjusted annualized rate) was a 2.6 percent decline from a month before and a 15.5 percent drop from a year ago. It also marks the lowest sales pace since the first quarter of 1998.

Contrast that to the RJ article from July 10 when the Las Vegas numbers came out.

Lawrence Yun, the Chief Economist for NAR continues:

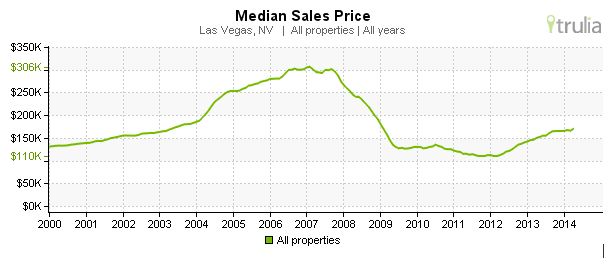

However, there are significant local market variations. Sales have continue to ramp up in markets where prices have come down by 20 percent to 30 percent. Bargain hunters and first-time home buyers who had been priced-out during the boom years have returned to the market. As before, sales are rising strongly on a year-over-year basis in:

- Ft. Myers

- Las Vegas

- Riverside

- Sacramento

- Prince Williams County, Virginia

Junes numbers in Las Vegas show us that 65% of the sales were bank owned foreclosed homes. That’s the other reason I forgot to mention in my post the other day about why I’m emphasizing the foreclosures. So let’s add one more to the article.

K) Some of the homes that are bank owned are so bad that they can’t be bought by regular “going to live in them†buyers. But LOTS of them just need some cleaning and loving. And they can be bought for prices that we had in 2003 and 2004. So far, it’s mainly investors who have been gobbling up those deals, in order to flip them or to rent them for a year or two. Home buyers shouldn’t be missing out.

Or, as I mentioned in C) in that column, many of the buyers I’m working with realize that that they’re not up to the task of buying a fixer upper. We’ve got lots of well loved and beautiful homes that are now priced realistically, and you don’t have to wait a week or two to get a response from the bank, and you’ll usually be the only one bidding on the property. Â