Have We Reached The Bottom In The Las Vegas Real Estate Market?

I talked to 287 people in 2011 who didn’t buy any real estate last year. Almost all of them wanted to buy a mid century modern home, or wanted into an historic neighborhood in the center of Las Vegas. After all – that’s what I do. That alone speaks volumes about the ever growing popularity of Vintage Vegas.

Universally, the main topic of the conversation was “when to buy?”. My answer was “when the time is right for you”. Those that did buy usually had a compelling reason. Most often – believe it or not – the reason was the rental home they were in was being foreclosed on and they couldn’t stand the uncertainty of when or if they’d be thrown out. Some just realized that with ridiculously low interest rates and prices, they’d be so much better off owning than renting.

Those that didn’t buy were almost all afraid to buy into a falling market. “I’ll buy when we hit the bottom” was usually the end of the conversation.

I sent all of them an email this morning. Here’s what it said.

During the last year or so I spoke to many people – including you – about real estate in Las Vegas. For many, it boiled down to “waiting till we get to the bottom”.

We believe that we’ve bottomed out now. Sure there’s some who disagree. There always will be. They usually get the headlines. The big, month after month declines have stopped. The sales volume for December and ALL of 2011 set a new record. EVERYTHING that’s for sale is bargain priced. Investment money is flooding in from all over the world, the phone is ringing off the hook, and the emails come in fast and furious. All are signs that we’re finally there. Yes, there will be some up and down monthly blips, but for all practical purposes we’re at the bottom. FINALLY!

We haven’t talked in quite some time, and it’s time we talked again. Whether you’ve considered a home to live in, or positive cash flow investment property, this year is when we should be putting a plan together for you.

And if you’re upside down on a mortgage, have fallen behind in your payments or have some other hardship – We should definitely be talking about short selling your current home and how long it will take till you could buy again.

If you’re still considering – it’s time to take some action. I invite you to call or email. Let’s talk!

Sincerely, Jack

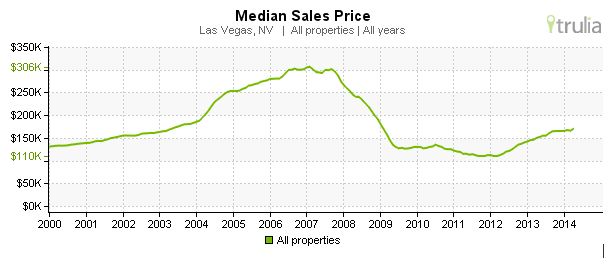

The following graphs were attached. They show the number of sales over an 11 year period and the medium price of homes during the same period. 2003 was the last year when we had prices that reflected “REAL VALUE” of homes. We base that on the expectations of buyers at different income levels.

For example – in 2003 a single person making $15.00 an hour (or $30,000/year) would expect to be able to buy 90,000 condo in a nice complex in a good part of town. They should also have been able to buy a cute retro 2 bedroom 1 bath in one of our terrific historic neighborhoods for the same 90 – $100,000. They could even have bought (in 2003) a much larger home in a crappy neighborhood for the same money.

Today – you can buy a 1500 -1800 square foot 3 bedroom 2 bath in a good neighborhood for the same money and with the same income. See what I mean? Five years ago that house was 200 to $250,000. Interest rates at the time were around 8%, and the only way to buy was with one of the funny money loans that got us into all the trouble in the first place.

So maybe (probably) you’re not one of the 287 people who received an email from me today. Maybe it’s time for you to have the conversation with me. Feel free to call me at 378–7055 or to email me at [email protected]

And just as I’m finally getting around to doing what I should be doing (writing a blog post) it’s time for you to consider what’s happening in the Las Vegas Real Estate Market – and do something about it! Let’s talk.