THE CLARK COUNTY REAL ESTATE MARKET

This is the long answer to the question I’m asked several times a day – “How’s the Market??”

f you have a question relating to your home, or the one you’d love to have – don’t hesitate to ask me. If you’d like to know the current value of your home – give me a call or drop me an email.

LAS VEGAS HOME PRICES CONTINUE TO RISE AS INVENTORY FALLS

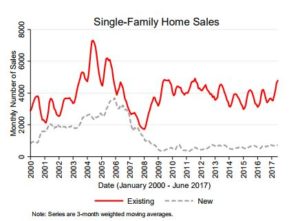

New and existing home sales increased on both a monthly and annual basis. Existing home sales have seen the most notable annual increase. There are over 500 more existing home sales in June 2017 than in June 2016.

New and existing home sales increased on both a monthly and annual basis. Existing home sales have seen the most notable annual increase. There are over 500 more existing home sales in June 2017 than in June 2016.

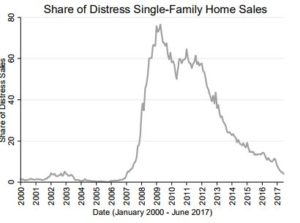

The distress share of sales saw a monthly decrease of one percent. This decrease is driven by a large decrease in REO (bank owned) sales and a slight decrease in short sales. 2017 has seen a monthly decrease in distress sales.

12% of mortgages were underwater at the end of the second quarter 2017, this is a 2% decrease since the first quarter of 2017 and a 5.4% decrease since the second quarter of 2016. 87% of people have equity in their homes compared to just 34% in 2011.

New Home sales have decreased on an annual basis for the third consecutive month. New Home sales are up 6.3, Existing home sales are up 13.4% and distressed home sales are down 66.4% since June, 2016.

While multifamily construction starts are up by 152 Units in the last year single family starts are down by 73 units.

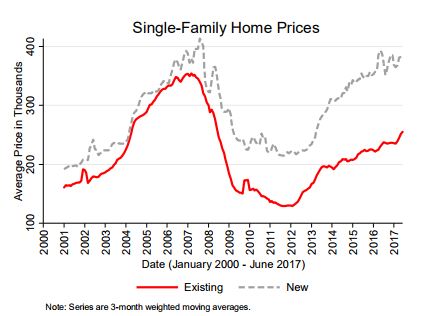

PRICES MOVING UP AT A MODERATE RATE FOR THE LAST THREE YEARS

Average single family sales prices for existing homes is up 9.4% over June 2016. This is holding fast for the last three years of existing homes averaging an increase of 10% per year. New home prices are not seeing the same increases though, they are down 2.2% since June 2016. Distressed homes are seeing the largest yearly increase of 11.7%

FLIPPERS AND LANDLORDS HAVE HAD THEIR DAY – IT’S TIME FOR MORE OWNER OCCUPANT SALES

Single family home sales are no longer being driven by investors. While 25% of home sales this year have been all cash a big part of that has been people moving from other states that have cashed out and buying in Las Vegas. They can get so much more for their money than in many of their home states. California leading the pack.

While Las Vegas is still number one in the nation for house flippers they are only 9% of the total sales in the last year. They are finding it harder to make larger profits on the homes since they are not seeing the 30% increases in value as they did for a few years after the crash. There are very few bank owned homes in inventory compared to four years ago for them to buy cheap, slap some paint on them and make big money.

While 10% increases per year is double what would be perfect there are many things driving our current market. Thousands of people are still moving to Nevada from other states. Many people that bought in 2013, 2014 are seeing good equity holdings and moving up. We have more buyers in the marketplace than sellers at this point so many listings are once again receiving multiple offers and selling higher then asking price.

Unemployment is the lowest in Nevada than it has been in ten years so you have more people looking to own their own homes with the rent prices going up.

No one can predict the future but there are factors pointing to the market to continue growing.

Home Buyer Increase Due to Disappearing Bankruptcies

Millions of people filed bankruptcy around 2010. Now, seven years later, these bankruptcies will begin to fall off, improving the credit score for millions of Americans, and enabling them to once again consider home-ownership.

Credit scores reached a record high this spring and the share of Americans in the riskiest borrower category hit an all-time low, according to the WSJ article. As bankruptcies continue to fall off credit reports, credit scores will continue to improve, and more consumers could begin to enter the housing market.

Even more millions of homeowners did a short sale and they are now becoming eligible to get purchase financing again.

This will create even more competition in an already tight market. Home prices continue to increase as inventory levels drop. And experts say don’t expect it to let up anytime soon.

And we don’t yet know the impact of this last hurricane season or the long term effect from the Raiders and Golden Knights coming to Las Vegas.

Graphs and some data provided by: