Are Free Credit Reports & Scores Trustworthy?

Every so often I get asked the same question a few times in a short period, which makes me think there are probably a lot more people out there who haven’t asked for whatever reason, but would still like to have the same information. Recently, that question has been about free credit scores (and more to the point, why are free credit scores different than what I pull for their loans…). So today I thought we’d do a Credit 101 so you and your clients have the information needed to make a good choice on free services. Please pass along to your client as you need.

Every so often I get asked the same question a few times in a short period, which makes me think there are probably a lot more people out there who haven’t asked for whatever reason, but would still like to have the same information. Recently, that question has been about free credit scores (and more to the point, why are free credit scores different than what I pull for their loans…). So today I thought we’d do a Credit 101 so you and your clients have the information needed to make a good choice on free services. Please pass along to your client as you need.

Some providers of free credit reports or free credit scores are legitimate. However (these are the big red flags to watch out for):

|

Free credit reports

Free credit reports are available all thanks to the Internet, but are they really free? And no less important, are they any good when it comes to mortgage financing?

We live in a data-driven economy. Every site visited, every link clicked, is recorded somewhere. Online profiles include thousands of data points, little hints regarding likes and dislikes, what is being purchaes and even political leanings are there.

Credit reports are part of the data economy. They reflect how we spend our money and how we use credit. Credit scores are derived from credit report information.

How to get free credit reports

The offer of a free credit report might be tied to the sale of other products and services. “Yes, we’ll give you a free credit report if only you’ll buy a side of magazine subscription and a set of truck tires. Click here….”

Well, okay, maybe not so blatant but you get the idea. That “free” credit report is not so free. Red flags should go off if you’re asked for a credit card number.

A “free” credit report is a bright and shiny thing to attract your attention. Some providers require a sign up for credit monitoring in exchange for the credit report. Others want contact information so that their partners can send offers or advertising.

If you or your client wants a truly free credit report, they should go to AnnualCreditReport.com. Under federal rules, we can all get one free credit report from the three leading credit reporting agencies (CRAs) – Equifax, Experian and TransUnion — each year. You can get three all together, or you can space out your requests over time.

How to use free credit reports

The reason to look at credit reports is to make sure they’re accurate. Look for outdated negative items. This might be information over seven years old, 10 years for Chapter 7 bankruptcies, and possibly longer for judgments.

Check the administrative information. Is the Social Security number right? How about addresses and dates? Are any items for credit events that don’t involve you? If you find a problem, contact the credit reporting agency immediately.

Can we trust the free credit reports found online? If we define the term “trust” to mean current and accurate, reports from AnnualCreditReport.com get a thumbs up. Free reports can help us find incorrect and outdated information. They can also help us spot identity fraud.

Credit scores

Both credit reports and credit scores come from your credit history. Think of credit reports as a big pile of receipts. Credit scores organize the information found in credit reports and tell us what us what it means.

In the same way that there are different credit report providers, there are also different credit score developers.

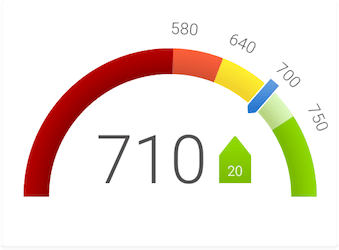

Mortgage lenders draw FICO credit scores based on credit reports from Equifax, Experian and TransUnion. Since the reports differ, the credit reports also vary. Lenders use the “representative” score to make decisions.

When they pull three bureaus, lenders use the middle score to qualify borrowers. If the scores are 714, 690 and 731 the 714 score will apply. If they only pull two bureaus, the lower score is the “representative” credit score.

Why FICO? The Federal Housing Finance Agency (FHFA) says all mortgages sold as of this writing to Fannie Mae and Freddie must include a FICO-brand credit score. FICO was developed by credit score pioneer Fair Isaac Corp.

Lenders generally – but not always – want loans which qualify for resale to Fannie Mae and Freddie Mac. For that reason, FICO scores dominate the mortgage credit field.

There is, in addition, the Vantage system developed by the three leading credit report agencies, Equifax, Experian and TransUnion.

Vantage wants its credit scores accepted by Fannie Mae and Freddie Mac. FHFA said it’s considering several credit scoring options, but as of early 2018 had “not determined which credit score option should be adopted as a replacement.”

Online credit score options

There is now a battle over credit score turf and territory. You can get free credit scores online. For example, Discover offers free FICO scores, noting that “you don’t have to be our customer and there’s no ding to your credit.” CreditKarma offers free Vantage credit scores from Equifax and TransUnion.

The scores you find online are considered “educational” and are not the scores most mortgage lenders use. In fact, there are over 40 different FICO scores used in different industries.

Still – and you can trust this – free credit scores can give a good sense of your credit standing. They’re a good way to monitor credit usage and alert you if anything suddenly changes.

Credit is linked more and more to a person’s identity these days. Even some jobs require a credit check before an offer is made now, so knowing your score (without getting taken for a ride) is critical today. If you or your clients have any questions about a credit service, your score, or the things that might get fixed to up your score, call me anytime. I am always at your service and happy to help.

This article was provided by one of the Lenders we work with and trust.:

Brad Malkin

Noble Home Loans

President

NMLS #100539

(702) 279-9111

(702) 932-7503

www.noblehomeloans.com

[email protected]

Jack LeVine has been trusted by well over a thousand clients in the last 28 years. He gets the job done – and gets it done right. No other agent in Las Vegas has the depth of knowledge and experience that Jack has of the vintage neighborhoods, the mindset of buyers for 50 or 60-year-old homes, and the special things that dramatically affect the value of a vintage home.

Jack LeVine has been trusted by well over a thousand clients in the last 28 years. He gets the job done – and gets it done right. No other agent in Las Vegas has the depth of knowledge and experience that Jack has of the vintage neighborhoods, the mindset of buyers for 50 or 60-year-old homes, and the special things that dramatically affect the value of a vintage home.

If you want to sell (or buy) a Vintage Las Vegas era home – Call or email Jack LeVine of Very Vintage Vegas Realty – 702-378-7055 [email protected]