Are Interest Rates Expected to Rise Over the Next Year?

So far this year, mortgage rates continue to hover around 3%, encouraging many hopeful homebuyers to enter the housing market. However, there’s a good chance rates will increase later this year and going into 2022, ultimately making it more expensive to borrow money for a home loan. Here’s a look at what several experts have to say.

Danielle Hale, Chief Economist, realtor.com:

“Our long-term view for mortgage rates in 2021 is higher. As the economic outlook strengthens, thanks to progress against coronavirus and vaccines plus a dose of stimulus from the government, this pushes up expectations for economic growth . . . .”

Lawrence Yun, Chief Economist, National Association of Realtors (NAR):

“In 2021, I think rates will be similar or modestly higher . . . mortgage rates will continue to be historically favorable.”

Freddie Mac:

“We forecast that mortgage rates will continue to rise through the end of next year. We estimate the 30-year fixed mortgage rate will average 3.4% in the fourth quarter of 2021, rising to 3.8% in the fourth quarter of 2022.”

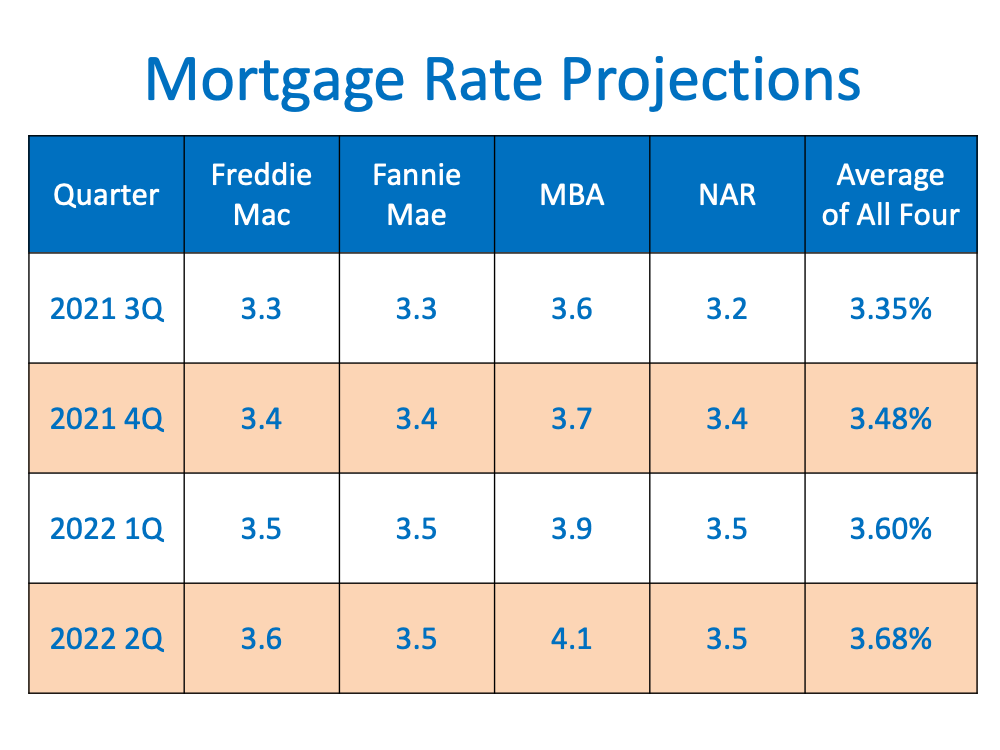

Below are the most recent mortgage rate forecasts from four top authorities – Freddie Mac, Fannie Mae, the Mortgage Bankers Association (MBA), and NAR:

Bottom Line

If you’re planning to buy a home, purchasing before mortgage interest rates rise may help you save significantly over the life of your home loan.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Very Vintage Vegas does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Very Vintage Vegas, will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.