Market Conditions

February 6, 2012

I talked to 287 people in 2011 who didn’t buy any real estate last year. Almost all of them wanted to buy a mid century modern home, or wanted into an historic neighborhood in the […]

January 19, 2010

The most common expression in the Real Estate world today is “FRUSTRATED FHA BUYER”. It applies to their agents as well. The vast majority of the bank owned properties on that come to market are […]

October 30, 2009

Remember that? It’s supposed to be the primary focus of VeryVintageVegas. I haven’t forgotten it. But looking back recently, VVV has gotten overwhelmed with “cultural stuff”. Most days, I’m so overwhelmed with appointments and paperwork […]

October 21, 2009

I can tell you from experience, and have said it many times before…… It’s not easy to buy a home now-a-days. The headlines may say the opposite, but the evil banks who control the inventory are making it […]

September 19, 2009

I’m going to spend more time on real estate this week. In keeping with that pledge, I thought I’d present some more proof about what I’ve been ranting about lately. I’m not the only agent with a list […]

August 20, 2009

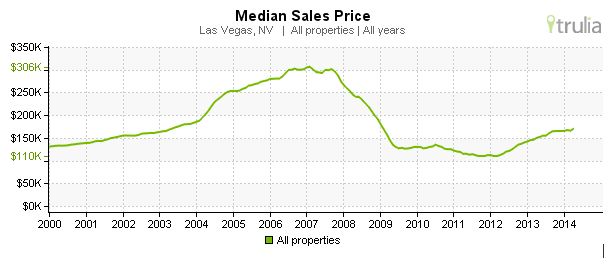

I’ve been seeing this for several months now….at least in Vintage Vegas. Now there’s city wide statistical evidence, for at least a one month increase of 900 dollars. YEA! It’s only one month but IT IS THE FIRST […]

July 13, 2009

I wish it had been a nice long extended vacation that’s kept me so occupied that I failed to post regularly over the last 10 days. There’s still a fortune to be made by whoever […]

June 27, 2009

Everyone says they’re looking for a bargain. How does 11 dollars a square foot sound. I was joking around a few months ago when we started seeing 25. a square foot homes in fabulous neighborhoods – […]

June 14, 2009

One measure of my success in “preserving and protecting the Historic Neighborhoods” is the volume of my to-do list and the number of buyers that I’m working with. Providing you with 2 or 3 posts […]

May 15, 2009

Down Payment Assistance has been around for a long time. It didn’t (in my opinion) cause or contribute to the bubble. Zero down and no qualifying easy money loans caused the bubble. Down payment assistance […]